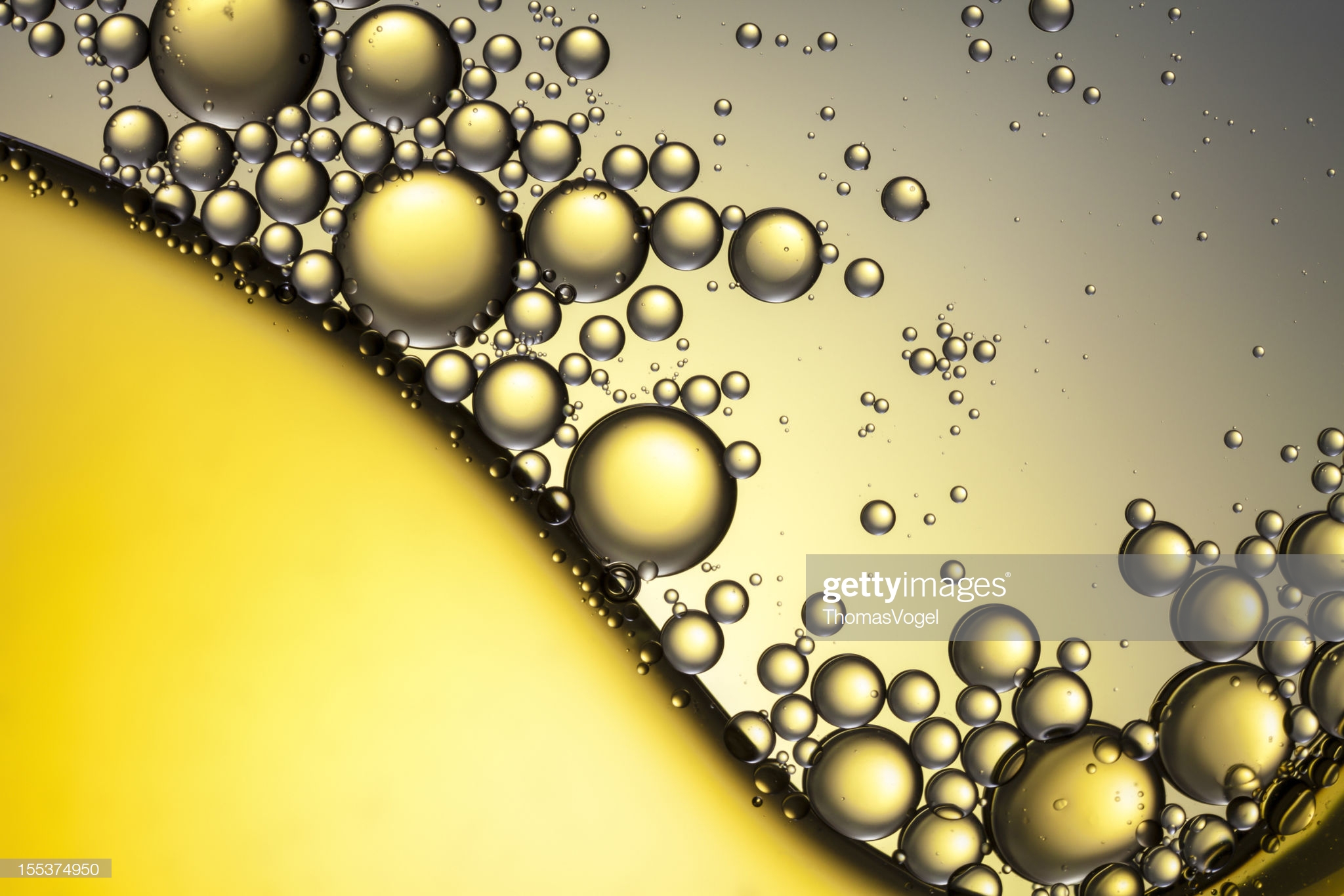

Gold and oil, which are the two most watched commodities in the world, acted in harmony during a long period of time when I was working in the markets. However, we see that this correlation has been reversed recently. Question: Is this break temporary or permanent?

High oil prices also raise consumer price indices and make the production and transportation of goods even more costly.

On the other hand, the reason why gold is so demanded is that it is seen as a hedge against inflation.

The geopolitical crises that occur whenever the oil is downwards (whoever is doing it now) cause the oil to go up.

Finally, as events such as drone attacks on Saudi Aramco plants or hitting an Iranian tanker prevent oil supply, they increase prices, increase inflation, and eventually slow economic growth. Gold takes advantage of this process.

In other words, until recently, although these two commodities did not directly affect each other, the high gold price was previously perceived as the high oil price in the market.

However, in the last 12 months, we see that oil prices have fallen while 25 percent of gold has gone up. My view was in fact that it should have fallen even more, but the Saudis’ efforts to buy and stamp Aramco caused oil prices to remain at these levels. (I personally think that those who buy Aramco shares will lose at least half their money!)

Whoever organized the Aramco attack doesn’t matter, as the rise in oil lasted only 2 days, and the surplus / demand weakness, in other words the fundamentals, prevailed. The market now wants to sell every rise because growth in the world is now negative. Just how negative it is can be discussed.

In the last 25 years, the Gold / Oil ratio is calculated as 15.8 in average. What this means is that it can receive 15.8 barrels of US WTI (West Texas intermediate, or Texas light sweet) in the last 25 years as a 1-ounce gold average.

When we look historically, we see that the lowest ration was 6.2 in 2005 and the highest ration was 47.6 in 2016.

The golden graphic appears below.

The Gold / Oil ratio has been seen as 24 averages since the beginning of this year. According to current prices, it is 27.9, or almost 80 percent above its historical average.

Below we see the 10-year crude oil, namely the WTI chart:

As a result, will this ratio return to normal historical levels, or will the ‘gap’ in between be opened?

The future of oil prices – as we have repeatedly mentioned in our previous articles – does not look good.

The graph below shows us the WTI (crude oil) – Gold (Gold) relationship: Oil production, which we have seen in the USA especially in the last 10-15 years, has created a huge supply in the market. The dream of being the ‘energy independence’ of the USA kind of struck itself. Oil produced in the USA is less affected by geopolitical developments – compared to Iran or Saudi. When the supply surplus in rock oil is curbed by the recession in the world economies and even the decline, the chance of oil prices going up decreases.

Gold, on the other hand, likes the low or negative interest environment in the world. It seems that after Europe and Japan, the USA will also go towards lower interest rates. Zero or minus interest bonds held in portfolios create great uneasiness in portfolios. If you say stocks make a new high every day, I ask you to what extent? For all these reasons, the demand for gold will increase. How much more will it increase? That we don’t know.

Good evening, stay lucky.