Today we will go into a little technical topic. I will try to explain myself as easy as possible.

Some names, such as the famous Michael Burry, predicted that a 2008 Lehman-type crisis will come from shares and index funds. We agree that the risk is low for the stock prices, but the big risk is the US dollar liquidity.

In banking balance sheet management, the first two biggest risks after liquidity are interest rate risk and FX risk. The vast majority of banks are weak in their balance sheets (liability sensitive). What does this mean? The maturity of their assets is longer than the maturity of their liabilities. Therefore, if there is an interest rate hike, there are risks of loss. Interest rates in the world are certain, there is stagnation and you will say that such a risk is not visible at the moment. The truth is that it is. Why? We will explain below.

The biggest debt in the world is in US dollars. Banks and companies are indebted in this way, especially in developing countries, transoceanic countries and many other countries in the world. These debts have grown tremendously since the early 1990s. These debts, which were 650 billion USD in the early 1990s, increased to 2.5 trillion USD in the early 2000s. The borrowing countries’ own currencies were strong against the USD. The risk was minimal then. In the first quarter of 2019, the total non-US debt (USD denominated debt to non-bank borrowers) rose to $12 trillion, despite the strong US dollar. Why do they borrow this way? Because they need US dollar liquidity, both for themselves and their customers. They have limited chances of creating these passives in their own country.

On the other hand, the same banks have to make money. Apart from the loans they give to their customers, they choose US dollar bonds to create assets because the majority of the bonds that can be earned in interest are in US dollars. In other currencies, unfortunately interest is negligibly low or negative, as in Europe or Japan. They fund these long-term bills with much shorter liabilities.

The second risk is the foreign exchange risk in the asset / liability balance. Banks outside the U.S. are able to borrow U.S. dollars (except those with very strong ratings), they must pay a spread on U.S. bonds (again according to their rating status) when they do. The increase in the US dollar creates a huge FX risk.

After summarizing these two risks briefly, let us come to what we want to say… As we mentioned in our previous article titled “Currency Wars”, the US does not want the US dollar to have a high supply volume. It already has his own over the fence debt, how will it withdraw this money when the supply is this excessive? While trying to shrink its balance sheet, this US dollar demand from other countries of the world is making the US itself uncomfortable.

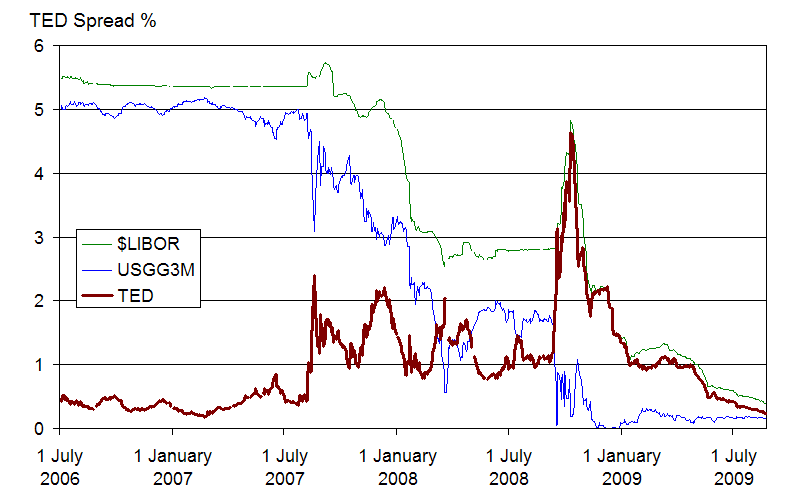

We speculate that we will face a US dollar liquidity crisis before this year ends. There was a major crisis in the world markets on Monday, September 15, with Lehman’s introduction to Chapter 11 (bankruptcy in common terms) on Sunday September 14 2008. Let’s talk cash, not even the largest banks in the world gave each other US dollars, not even from FX swaps. Short-term US interest rates (over FX swaps) exceeded 20 percent between September 15 and October 8, 2008, and the Fed cut the interest to zero on October 8, 2008.

Unfortunately, the situation we are in reminds us of those days. The European banks’ situation is at least as difficult or even as hopeless as in developing countries. Why? Because they do not give credit in the domestic market, or they hardly do sometimes. Compliance departments are tied up by those who want to do business. Regulators are in an effort to protect their business. European banks, whose ratings are still good and can find cheap money, are sitting on liquidity from central banks. They think they are safe! Compliance departments will soon see how their undeserving popularity are lost in the upcoming crisis, but unfortunately it will be too late.