There is this discussion we often hear. Currency wars, foreign currency wars… What is this? What is its history? Let’s take a look without further ado.

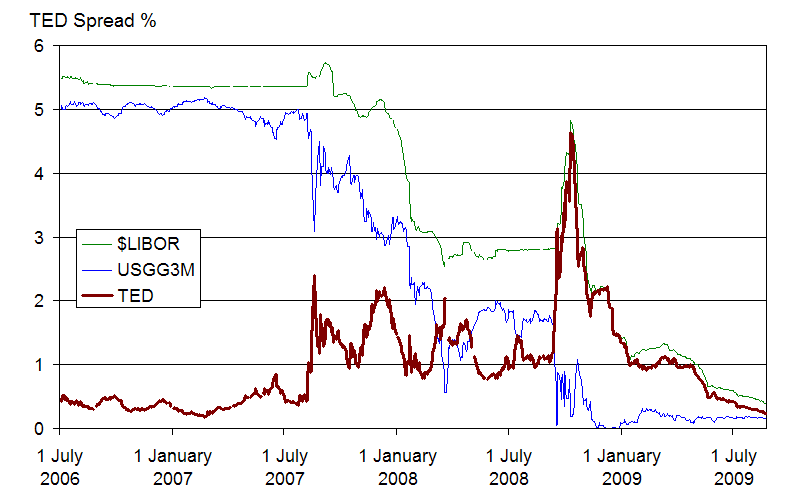

As we know, the US dollar is currently the largest reserve currency in the world. The US derives this power from the military and political power it gained after World War I and II. The Normandy landing in World War II, the liberation of Europe from Nazi Germany and the subsequent destruction of Japan especially allowed the US to sit on the table as a big brother against other major powers of the world. In addition to being the largest military and political force, the US rose to the largest creditor position. In 1944, the Bretton Woods system prepared by the famous British economist John Maynard Keynes was adopted (though officially in 1945). The original agreement of 44 countries was the fixation of their own currency against the US dollar in order to recover the economies of the countries that lost or were damaged during World War II. This would give them a chance to recover themselves. Only 1 percent of flexibility was provided daily. In fact, Keynes went a step further and offered a single (global) proposal, but this proposal was not accepted. The US dollar was fixed not only against the money of other countries, but also against gold. 1 USD = 35 oz of bullion. During this period, the IMF and World Bank were established. The purpose of the system was to prevent the US dollar from being overprinted. France, most likely due to its debt from history, accepted this agreement. He requested gold from the US and did not use the US dollar as a reserve coin. But West Germany and Japan went on developing their industries and selling goods and improving their export-oriented economies. Seen in the 1950s During this period, IMF and Dunya Bank were established. The purpose of the system was to prevent the US dollar from being overprinted. France – it must have been due to its debt from history – fits this agreement exactly. He requested gold from the US and did not use the US dollar as a reserve coin. But West Germany and Japan turned to developing their industries and selling goods and developing their export-oriented economies. Unlike the US dollar deficiency, an incredible USD surplus occurred in the world in late 1960 because the German central bank Bundesbank (Buba) and the Japanese central bank BOJ were stacking US dollars. World price inflation started to rise. Big profits were created for foreign currency speculators because interest differences between the US and West Germany / Japan offered great opportunities. US President Richard Nixon put his hands on the subject in 1971. In 1973, when other major world powers had to remove the fixed anchor from their money, the stocks went down, oil and inflation flew, banks went bankrupt. Afterwards, during the Cold War and Ronald Reagan, the US dollar started to fall until 1994. This process continued until the emergence of the Euro in January 1999. The emergence of the euro hurt the work of the banks that made big money from the trades on the German Mark, French and Belgian Francs, Spanish peseta, Portuguese escudo, which we call in-currency, but there was nothing to do… A new period had begun. The euro (against the US dollar) opened from 1.1747 in the first hours of the first trading day, it lost a very long period after seeing 1.1906 high in New Zealand and Australia sessions. It regressed to 0.85s. US could not allow this, after making 1.60 high, it is currently trading just below 1.11. It is very important for the US that the US dollar remains as reserve currency. In this way, it can meet his trade deficits with a rising foreign debt and printing money. But it is no longer the biggest creditor in the world. China and Southeast Asia developed their economies. China is now the biggest creditor in many African countries. Finally, WHEN and not IF a 2008 Lehman-type big wave will arrive, which seems to potentially be happening very soon, the winner will be the US dollar again.